bull market - bull market indicator

Again I hear so many people say the bull market is gone, and we are in a bear market.

They are also saying we are not in a bull market right now. Is this true, or a lie?

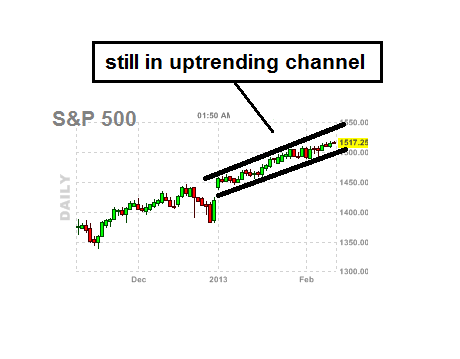

Well in all my years as an analyst, I do not read newspapers or listen to the so called gurus, I always come back to the charts, not matter if we are in a bull market or a bear market. Always remember the charts never lie, I mean NEVER!

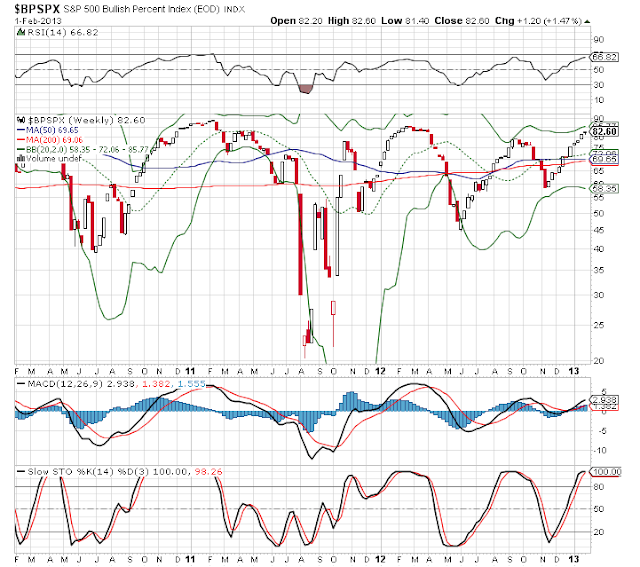

The bull market / bear market indicator is saying that right now we are in a bull market. Now this does not mean we cannot go down or sell off violently at some stage, but this indicator is very good for seeing the longer term picture and very reliable. Buying the dips has been working very well for a few years now.

Since 2009 the bears have struggled badly, they have had their chances to go short along the way, however just as they got excited, the market turned on them yet again and we started travelling up again.

As you can see on the chart below, the current bullish market started in January 2012 and we are now a few hundred points higher on the SPX.

The bears out there have obviously not looked at charts like this, and keep trying to go short or call a crash. As said, even if we sell off hard, the direction of this market is up, and we have a good plan to make money no matter what happens anyway.

|

| bull market indicator |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!