2013 economic recovery - Is the

2013 economic recovery real?

|

| 2013 economic recovery |

This is a decent question and there is only one real answer. NO! the 2013 economic recovery is not real.

Here is why.....

Since the fed announced this whole tapering of stimulus it has crated alot of volatility in the markets. Basically the markets believe that the fed had an exit strategy for tapering the Quantitative Easing and after the bond bond buying program it would take some poor data to take them off course for them to do that.

Right now Ben Bernanke says it is going to take lots of positive data to even think about tapering off. There are some fed board members who think the US is strong enough to come off life support but other members like Bernanke who think it might be too soon to be doing that and they want to be sure that the recovery in the US is strong enough to take some of the accommodation away. What they are worried about is the the fact that long term rates are moving higher which pushes up mortgage rates also. The whole recovery in the US seems to be based on a fake stimulus that is not even working.

Also since the 2008 crisis, this so called come back in the housing markets is not real as well, and the fed do not want to kill that, they want to keep the false sense of security out there going, and make it seems like the housing market and stock market are recovering together. So far this play is working very well.

Right now the story is playing out perfectly, even though there still is a real divide right now Bernanke is the only real one calling the shots. He is not in any hurry to take away the accommodation and kill this so fake recovery yet. That would be catastrophic no doubt.

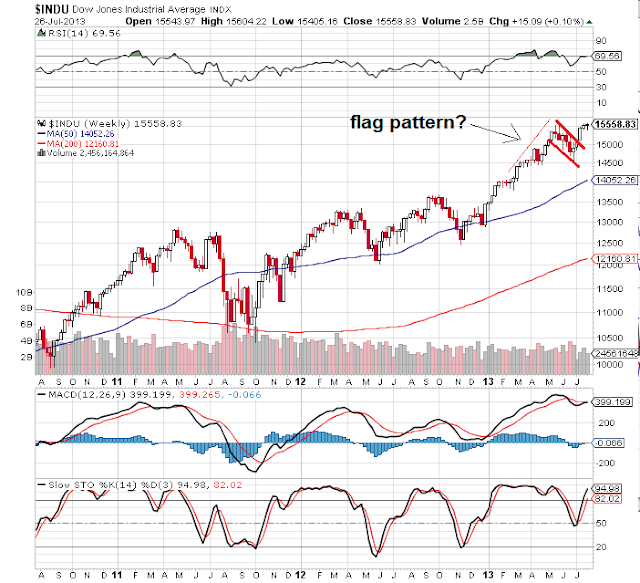

As you can see right now, the markets are extremely sensitive to what the fed and any central banker has to say about quantitative easing and the fact that they want to start tapering off soon. This week, Ben gave no assurances that tapering could occur at all and the market skid up higher. Again this is proof that we are going to see lots of reaction to talks about tapering and quantitative easing in the coming months.

Bernanke was clear that they want to see more recovery in the jobs market first. So it safe to say the FED opinions have altered quite dramatically in the last 24 hours.

Half of the FOMC policy makers do believe the US economy is showing signs of recovery and strength and it is showing up in some of the job numbers we saw last week. However the doves of the FED believe it is not quite there yet and they want to see more evidence that this 'fake recovery' is self sustaining.

The IMF have lowered the US growth for the coming 12 months. Also other major investment banks have lowered their forecasts for the US, so there is very much a differing of opinions right now as to where the US is really heading.

We all know the truth, this so called 2013 economic recovery is a NOT A REAL RECOVERY at all, in fact, it is nothing more than a fairy tale story we keep hearing on the TV and on the radio every day. People keep believing in the fairy tale because they keep getting told what they want to hear. But pumping up the real economy by printing money out of thin air is only going to end in tragedy, you do not have to be Nostradamus to predict this will happen.

It is not a matter of if it will happen, but now only when this will happen. No one expects things to crumble, but they will crumble at a time when most people do not expect it, that is how the global elite steal from the poor to pay the rich again and again.

Powered by |