5 Reasons Why Gold Will Plunge Further

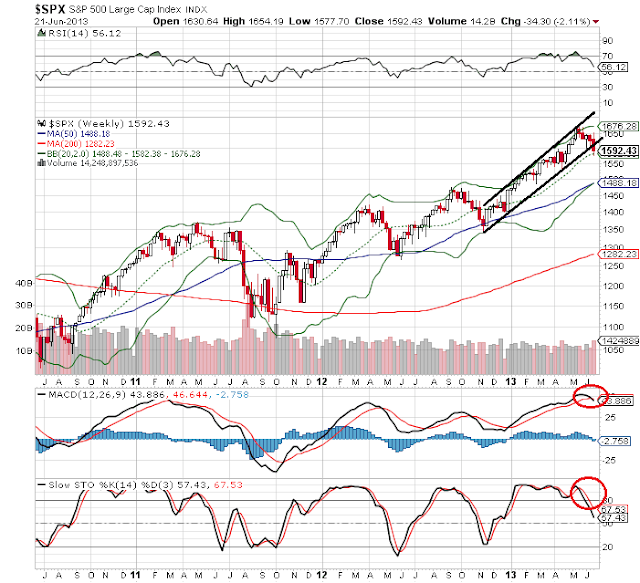

We have already showed the gold chart here on the blog. Here is an update version.

|

| 5 Reasons Why Gold Will Plunge Further |

This chart above does not look particularly well for gold. Infact the targets off the top of the triangle lead all the way down to 1150 or so level, so the trouble is not over for gold yet technically no doubt.

But....

Here are the 5 Reasons Why Gold Will Plunge Further

In its second downgrade since April, HSBC is now predicting that the average gold price will be $1,396 in 2013, down from $1,542. While UBS last week changed its 12-month forecast by more than 40 percent to $1,050.

The reasons for this downgrade are five-fold says HSBC. From the U.S. Federal Reserve tapering its bond buying program leading to a stronger dollar to falling demand from India and China as growth slows in these emerging economies, all factors are going to take the precious metal lower in coming months.

"After an initially encouraging upwards price performance in the aftermath of the April sell-off, which lasted until early May, the bullion rally lost momentum and gold and silver prices resumed their slide, with losses accelerating notably in the aftermath of the June 18-19 FOMC [Federal Open Market Committee] meeting," HSBC said in a note, referring to the Fed meeting when chief Ben Bernanke signaled that it could soon scale back its $85 billion a month bond buying program.

Gold prices have plunged over 20 percent since April to around $1,276 on Tuesday.

India and China Weigh

Besides the Fed factor, the growing pessimism over China's growth prospects will also weigh on gold prices as the world's second largest economy is also the second largest consumer of gold.

"Our economists cut 2013 China GDP [gross domestic product] forecast from 8.2 percent to 7.4 percent and 2014 GDP forecast from 8.4 percent to 7.4 percent," HSBC said.

Plus India, the largest consumer of the precious metal has also taken steps to curb appetite for gold.

"Increased import duties and the Indian government's efforts to reduce gold imports are curbing that nations' demand for bullion and crimp jewelry demand," HSBC said.

On Monday, India's largest jewelers' association - the All India Gems and Jewelry Trade Federation - that represents about 90 percent of jewelers asked members to stop selling gold bars and coins, adding to the government's efforts to cut gold imports and stem a growing current account deficit, Reuters reported.

Besides lackluster demand for physical gold, HSBC says a stronger U.S. dollar as the Fed withdraws liquidity will lead to more weakness in gold. The dollar index, which measures its value against a basket of foreign currencies, is up over 4 percent from a yearly low in February.

Finally, another support for gold - central bank buying is now either falling or not growing as quickly, HSBC said.

"These [gold] reserves are now either falling or not growing as quickly due to declines in current account balances in many emerging market nations as a consequence of the slowdown," the bank wrote.

Here are the 5 Reasons Why Gold Will Plunge Further

Powered by |

BLOCKED CONTENT HERE - PREMIUM VIP MEMBERS ONLY!

BLOCKED CONTENT HERE - PREMIUM VIP MEMBERS ONLY!  BLOCKED CONTENT HERE - PREMIUM VIP MEMBERS ONLY!

BLOCKED CONTENT HERE - PREMIUM VIP MEMBERS ONLY!