HAPPY EASTER EVERYONE!!

As you can see our FREE blog houses all our ideas, charts, technical analysis. We are top of our game and accurate, as you can see, but just wait till you see what is in our VIP section here.

JOIN OUR HIGHLY ELITE TRADERS AND ANALYSTS AND LEARN THE BEST KEPT SECRETS IN MAKING MONEY ON THE GLOBAL AND US STOCK MARKETS!

DON'T GAMBLE WITH YOUR HARD EARNED MONEY! LEARN EVERYTHING YOU HAVE ALWAYS WANTED TO KNOW ABOUT MAKING CONSISTENT MONEY ON THE MARKET QUICKLY! LET THE GURUS HOLD YOUR HAND AND SHOW YOU WHAT THEY ARE DOING EXACTLY AT THE PRECISE MOMENT.

SCREW WHAT WE THINK!.... LISTEN TO WHAT OUR CURRENT CLIENTS ARE SAYING ABOUT OUR VIP SERVICES! CLICK HERE TO READ CURRENT VIP TESTIMONIALS!

IF YOU ARE SERIOUSLY INTERESTED IN TRADING LIKE THE PROFESSIONALS DO AND ANALYZING THE MARKETS PROPERLY, THEN OUR VIP GROUP IS FOR YOU! APPLY NOW AS THIS OFFER IS LIMITED AND WE CAN CLOSE IT AT ANY TIME!

PLEASE NOTE : THIS IS AN EXCLUSIVE OFFER! THERE ARE LIMITED MEMBERSHIPS AVAILABLE SO DON'T DELAY! ACT NOW! HIT THE APPLY BELOW IT ONLY TAKES 2 MINUTES!

Our VIP section here. is now open, and we would like to invite you to join our services so you can benefit from all our analysis.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The Sentiment Trader - "Follow the smart money and learn how to take consistent profits from the market each month".

Friday, 29 March 2013

usd daily chart update

usd daily chart update

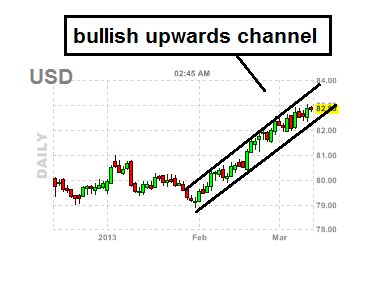

If we take a look at the us dollar daily chart you can see that we still in a major upwards channel, and things look very strong. At the moment there is lots of panic around the Cyprus crisis and people are still looking somewhere for safety. The USD is one of those vehicles.

up and up and up she goes, where she stops nobody knows?

I wouldnt be surprised if we see the 84 level come very soon.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

If we take a look at the us dollar daily chart you can see that we still in a major upwards channel, and things look very strong. At the moment there is lots of panic around the Cyprus crisis and people are still looking somewhere for safety. The USD is one of those vehicles.

up and up and up she goes, where she stops nobody knows?

I wouldnt be surprised if we see the 84 level come very soon.

|

| usd chart |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Wednesday, 27 March 2013

bullish pennant - market breakout

bullish pennant - market breakout

it seems we were correct with our bullish pennant and market breakout call for the US dollar just 24 hours ago.

As you can see below, the USD took just 24 hours for the pennant to break to the upside just as we were predicted :-)

This bullish pennant and market breakout for the US dollar makes it even stronger now and it may be a game changer.

it seems we were correct with our bullish pennant and market breakout call for the US dollar just 24 hours ago.

|

| pennant breakout |

As you can see below, the USD took just 24 hours for the pennant to break to the upside just as we were predicted :-)

This bullish pennant and market breakout for the US dollar makes it even stronger now and it may be a game changer.

Free SENTIMENT Newsletter (Worth $97)

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

For all other enquiries ==> CLICK HERE TO CONTACT US

.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

.

bitcoin generation - Welcome To The Bitcoin Generation

bitcoin generation

Hey you! Welcome to the bitcoin generation !!!!

Hey you! Welcome to the bitcoin generation !!!!

|

| bitcoin generation |

From : CNBC

They won't make a sound no matter how many of them you try to toss in a bucket, and you can't pitch them in a fountain and wish for good luck. But make no mistake, bitcoins are getting big. Welcome to the bitcoin generation.

The online alternative currency, previously little more than a curiosity in financial markets since its 2009 inception, has zoomed in trading value since the Cyprus banking crisis erupted two weeks ago.

With fears spreading that even insured deposits might not be safe in similar nations hit by banking crises, those looking for a haven to store their wealth have fled to the complicated world of digital cash.

"Incremental demand for bitcoin is coming from the geographic areas most affected by the Cypriot financial crisis—individuals in countries like Greece or Spain, worried that they will be next to feel the threat of deposit taxes," Nicholas Colas, chief market strategist at ConvergEx, said in a report on the startling trend.

This could be a very big start to a whole new bitcoin generation that until a few days ago, was not even really comprehensible.

Bitcoins operate on a network that, at least on the surface, resembles a typical exchange on the capital markets. Buyers can exchange their paper currencies for bitcoins and use them wherever they are accepted. Sellers can exchange their bitcoins back for their original currency.

But the value of the currency has been anything but typical.

Bitcoincharts.com lists the value of bitcoins compared to other currencies, including U.S. and Canadian dollars, euros and pounds.

On one of the U.S. currency exchanges, labeled "Mt. Gox," the bitcoin value has zoomed to more than $87 in Wednesday trade. That represents close to a 20 percent gain over just the past week, a one-month gain of 41 percent and nearly a quintupling of value in the past year.

The "Mt. Gox" euro trading has seen numbers nearly identical to the dollar pairing.

But some suggest the bitcoin generation is just a fad, and not really sustainable longer term.

A more sober perspective might suggest that bitcoins are at best a momentary bubble and at worst a risky chance to take considering their novelty.

But the trend also exemplifies just how nervous cash-holders are over the European situation.

"This is a clear sign that people are looking for alternative ways to get their money out of the country," said Christopher Vecchio, currency analyst at DailyFX. "If we're going to talk about the stability of the euro and whether or not there are going to be capital controls in place not just in Cyprus but around the euro zone, I think there is some efficacy behind bitcoins as an alternative liquidity vehicle."

The role of alternative currency had been falling largely to gold over the past several years. But the precious metal has been on a pretty aggressive downward path since its most recent peak in October.

Gold advocates and those that are realizing this new bitcoin generation, continue to stress its importance as a safe haven and store of wealth.

"Why would anyone trust an electronic form of money that could get hacked and then diluted into oblivion?" said Michael Pento, president of Pento Portfolio Strategies. "We already have a form of money that is indestructible and whose supply cannot be increased by any government or individual decree. It's called gold."

Yet currency pros are at least willing to give bitcoins and this whole new bitcoin generation the benefit of the doubt as a legitimate trading vehicle as situations like Cyprus continue to crop up.

The $964 million bitcoin network pales to the $4 trillion a day in total currency trading, but it's clearly growing.

"Right now it seems safe. Personally it wouldn't be my preferred vehicle to trade money because it's unregulated," Vecchio said. "But people are deeming it legitimate even though it's not backed by a sovereign. That could be the attraction behind it. There's no sovereign credit risks to bitcoins."

Is the bitcoin generation here to stay or not, time will tell.

Free SENTIMENT Newsletter (Worth $97)

.

.

USD chart - Pennant Pattern

USD chart - Pennant Pattern

Since the start of March 2013 the USD has not really done much at all. However now we are at the end of market, you can see that both the buyers and sellers have been squeezed and this is now a pennant pattern.

Eventually this will have to breakout to the upside or down below on the downside.

The rules with pennants state they will break the direction of the price action that precedes them. So in this case, it is most likely the USD price will break to the upside, past 23 and head higher.

If this is indeed a pennant and the USD is inside a pennant as drawn above, the USD should rise, and the market will come into trouble. Right now things are still in limbo no doubt.

The only downdraw to all this, is that pennants can last for days, weeks or months, however this pennant looks to be a good one, and we will continue to monitor the currency market after the EASTER break.

Since the start of March 2013 the USD has not really done much at all. However now we are at the end of market, you can see that both the buyers and sellers have been squeezed and this is now a pennant pattern.

Eventually this will have to breakout to the upside or down below on the downside.

The rules with pennants state they will break the direction of the price action that precedes them. So in this case, it is most likely the USD price will break to the upside, past 23 and head higher.

|

| pennant pattern |

If this is indeed a pennant and the USD is inside a pennant as drawn above, the USD should rise, and the market will come into trouble. Right now things are still in limbo no doubt.

The only downdraw to all this, is that pennants can last for days, weeks or months, however this pennant looks to be a good one, and we will continue to monitor the currency market after the EASTER break.

Free SENTIMENT Newsletter (Worth $97)

.

.

Tuesday, 26 March 2013

vix historical prices - a look at vix historical prices

vix historical prices

taking a quick look at the vix historical prices we can see how turbulent this year has been in terms of news, and news driven events.

The vix historical prices chart below clearly shows the drama early in 2013 with the fiscal cliff saga, then the sequester just a few weeks ago, and now with the problems in Cyprus and the bank bailouts, the vix chart remains buoyant and very erratic as investors look for a safe place to park their money.

vix historical prices

taking a quick look at the vix historical prices we can see how turbulent this year has been in terms of news, and news driven events.

The vix historical prices chart below clearly shows the drama early in 2013 with the fiscal cliff saga, then the sequester just a few weeks ago, and now with the problems in Cyprus and the bank bailouts, the vix chart remains buoyant and very erratic as investors look for a safe place to park their money.

vix historical prices

|

| vix historical prices |

Free SENTIMENT Newsletter (Worth $97)

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

For all other enquiries ==> CLICK HERE TO CONTACT US

.

Powered by 123ContactForm | Report abuse

.

Monday, 25 March 2013

Why the S&P 500 Just Can't Break its Record High

Why the S&P 500 Just Can't Break its Record High

Everyone is asking Why the S&P 500 Just Can't Break its Record High ? That is a good question?

Why the S&P 500 Just Can't Break its Record High.... here is the most likely reason why.

Source : Cnbc

Call it bad timing or just back to reality, but the Standard & Poor's 500 all-time high has become a significant barrier to stock market gains.

For the fifth time in the past two weeks the broad-based index came within 5 points of its record, only to be beaten back either by technical resistance or, as was the case Monday, more disturbing global headlines.

"There's resistance to climb over a high that hasn't been breached since '07. It takes a tremendous push," said Mitchell Goldberg, president at ClientFirst Strategy.

"There's an awful lot of people out there who are just breaking even now, who have become more risk-adverse and have had enough of risk-taking in the stock market," he added. "The news cycle doesn't help."

Indeed, it was the latest out of Europe that pulled the stock market down Monday, with an agreement to bail out Cyprus banks rattling investors concerned about the deal coming apart and its contagion risk. Markets were also spooked by comments from Dutch finance minister Jeroen Dijsselbloem saying that the Cyprus bailout deal might be a template for other bank bailouts in Europe.

Mark Newton, Greywolf Execution Partners chief technical analyst, turns an eye on where the S&P is headed as it approaches an all-time high.

Unease over the deal pulled the S&P 500 back as it climbed within 1 point of its all-time closing high of 1,565.15, set on Oct. 9, 2007. Why the S&P 500 Just Can't Break its Record High is a combination of a few things.

Traders follow the S&P 500 more closely than the Dow industrials, which garners more of the public attention and has streaked to a series of nine new historic highs in the past several weeks.

"It doesn't really matter if the Dow hits a new record. It has to be the S&P 500," Goldberg said.

The S&P covers a wider swatch of corporate America than the Dow, which is seen as an economic bellwether even though it contains just 30 stocks.

Consequently, many traders still want another green light before believing the violent stock rally over the past three months is sustainable.

"Stock indices continue to suffer from the 'get no respect' syndrome as new highs for the Dow Jones and the S&P 500 are met with deep concerns about the sustainability of the advance and questions regarding any opportunity for more appreciation," Tobias M Levkovic, chief market strategist at Citigroup, said in a market analysis. "We have become fascinated by the constant stream of rationalizations for not believing in the gains," he added.

Levkovich believes slow but steady earnings growth and the market's ability to shrug off concerns over European weakness will help keep the market on a positive keel higher.

Still, that hasn't stopped investors from worrying.

"The daily grind higher in U.S. equity prices is acting like water torture for both bulls and bears," Sam Stovall, chief equity strategist at S&P Capital IQ, said in a recent report for clients. "Investors are in search of a new catalyst to trigger the next move."

Like many others in the market, Stovall has been waiting for a pullback from a seemingly unflappable 2013 rally that has seen the broad-based index swell nearly 10 percent.

Sentiment indicators have been volatile, with the most recent American Association of Individual Investors survey at 39 percent for those expecting the rally to continue. That's nearly perfectly in line with the historical average, while the bearish level of 33.3 percent is a bit higher than the norm.

But a retreat seems nowhere in sight as the market continues a fairly uneventful melt-up into rarefied air and this is Why the S&P 500 Just Can't Break its Record High

Bank of America Merrill Lynch attributes the market move higher to a "seller's strike" in which investors are anticipating a rollover of money from bond funds into stocks.

Even in the firms' bullishness, though, it also would like to see some kind of retreat to sustain the rally.

"The big question is, can stocks hold or extend these highs? Our asset allocation is skewed toward a view that yes, equities can extend their gains over the course of 2013," said Michael Hartnett, BofA's chief investment strategist. "But we also continue to think the probability and durability of that outcome would be improved by a healthy pullback."

The S&P 500's intraday high is 1,576.09, set on Oct. 11, 2007.

Why the S&P 500 Just Can't Break its Record High

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Everyone is asking Why the S&P 500 Just Can't Break its Record High ? That is a good question?

|

| Why the S&P 500 Just Can't Break its Record High |

Why the S&P 500 Just Can't Break its Record High.... here is the most likely reason why.

Source : Cnbc

Call it bad timing or just back to reality, but the Standard & Poor's 500 all-time high has become a significant barrier to stock market gains.

For the fifth time in the past two weeks the broad-based index came within 5 points of its record, only to be beaten back either by technical resistance or, as was the case Monday, more disturbing global headlines.

"There's resistance to climb over a high that hasn't been breached since '07. It takes a tremendous push," said Mitchell Goldberg, president at ClientFirst Strategy.

"There's an awful lot of people out there who are just breaking even now, who have become more risk-adverse and have had enough of risk-taking in the stock market," he added. "The news cycle doesn't help."

Indeed, it was the latest out of Europe that pulled the stock market down Monday, with an agreement to bail out Cyprus banks rattling investors concerned about the deal coming apart and its contagion risk. Markets were also spooked by comments from Dutch finance minister Jeroen Dijsselbloem saying that the Cyprus bailout deal might be a template for other bank bailouts in Europe.

Mark Newton, Greywolf Execution Partners chief technical analyst, turns an eye on where the S&P is headed as it approaches an all-time high.

Unease over the deal pulled the S&P 500 back as it climbed within 1 point of its all-time closing high of 1,565.15, set on Oct. 9, 2007. Why the S&P 500 Just Can't Break its Record High is a combination of a few things.

Traders follow the S&P 500 more closely than the Dow industrials, which garners more of the public attention and has streaked to a series of nine new historic highs in the past several weeks.

"It doesn't really matter if the Dow hits a new record. It has to be the S&P 500," Goldberg said.

The S&P covers a wider swatch of corporate America than the Dow, which is seen as an economic bellwether even though it contains just 30 stocks.

Consequently, many traders still want another green light before believing the violent stock rally over the past three months is sustainable.

"Stock indices continue to suffer from the 'get no respect' syndrome as new highs for the Dow Jones and the S&P 500 are met with deep concerns about the sustainability of the advance and questions regarding any opportunity for more appreciation," Tobias M Levkovic, chief market strategist at Citigroup, said in a market analysis. "We have become fascinated by the constant stream of rationalizations for not believing in the gains," he added.

Levkovich believes slow but steady earnings growth and the market's ability to shrug off concerns over European weakness will help keep the market on a positive keel higher.

Still, that hasn't stopped investors from worrying.

"The daily grind higher in U.S. equity prices is acting like water torture for both bulls and bears," Sam Stovall, chief equity strategist at S&P Capital IQ, said in a recent report for clients. "Investors are in search of a new catalyst to trigger the next move."

Like many others in the market, Stovall has been waiting for a pullback from a seemingly unflappable 2013 rally that has seen the broad-based index swell nearly 10 percent.

Sentiment indicators have been volatile, with the most recent American Association of Individual Investors survey at 39 percent for those expecting the rally to continue. That's nearly perfectly in line with the historical average, while the bearish level of 33.3 percent is a bit higher than the norm.

But a retreat seems nowhere in sight as the market continues a fairly uneventful melt-up into rarefied air and this is Why the S&P 500 Just Can't Break its Record High

Bank of America Merrill Lynch attributes the market move higher to a "seller's strike" in which investors are anticipating a rollover of money from bond funds into stocks.

Even in the firms' bullishness, though, it also would like to see some kind of retreat to sustain the rally.

"The big question is, can stocks hold or extend these highs? Our asset allocation is skewed toward a view that yes, equities can extend their gains over the course of 2013," said Michael Hartnett, BofA's chief investment strategist. "But we also continue to think the probability and durability of that outcome would be improved by a healthy pullback."

The S&P 500's intraday high is 1,576.09, set on Oct. 11, 2007.

Why the S&P 500 Just Can't Break its Record High

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The Bullish Percent Index

The Bullish Percent Index & SPX chart

The Cypres News is still not playing well with the market, as you can see we have not really done much over the last week or so. Each time the market gets up to the highs, they are rejected.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The Cypres News is still not playing well with the market, as you can see we have not really done much over the last week or so. Each time the market gets up to the highs, they are rejected.

|

| spx chart |

The bullish percent index, now has a lower high, and most the time that does not bode well for the market. The next week or so, are going to be very critical if the bulls if they want to regain their footing. So far they are losing the fighting battle.

|

| bullish percent index |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Labels:

bears,

bullish percent index,

bulls,

correction coming,

spx,

spx chart,

technical analysis

Sunday, 24 March 2013

The Air Up There

After new highs each week on the market, you can see the dow jones, has hit some headwinds, and has not really done much at all in the last few weeks.

The levy news in cypress did not help one bit, and it is obvious from the chart below, traders right now are in a 'wait and see' approach.

The levy news in cypress did not help one bit, and it is obvious from the chart below, traders right now are in a 'wait and see' approach.

Free Newsletter (Worth $97)

.

.

Labels:

correction,

cypress bailout,

cypress news,

djia chart,

dow jones,

the air up there

Friday, 22 March 2013

goldman sachs technical analysis - latest goldman sachs technical analysis

goldman sachs technical analysis

goldman sachs technical analysis of the daily goldman sach chart.

Taking a look at the goldman chart below it is obvious that we have broken significant support at around the 145 level. It seems that goldman sachs has also broken a descending triangle pattern also, and that could spell trouble in the short term.

We have to remember the main reason this is significant. The weeks leading up to the high in FEB 2013 goldman sachs seemed to have led the rally. Now the market is stalling and goldman sachs seems to be starting to sell off. That could be the warning sign right there.

We will continue to monitor this chart in the coming weeks.

goldman sachs technical analysis of the daily goldman sach chart.

Taking a look at the goldman chart below it is obvious that we have broken significant support at around the 145 level. It seems that goldman sachs has also broken a descending triangle pattern also, and that could spell trouble in the short term.

We have to remember the main reason this is significant. The weeks leading up to the high in FEB 2013 goldman sachs seemed to have led the rally. Now the market is stalling and goldman sachs seems to be starting to sell off. That could be the warning sign right there.

We will continue to monitor this chart in the coming weeks.

|

| goldman sachs technical analysis |

Free SENTIMENT Newsletter (Worth $97)

.

.

Thursday, 21 March 2013

dow jones chart 2013 - dow jones chart 2013

dow jones chart 2013

This is a chart of the dow jones chart in 2013 and so far we have been travelling up nicely in an upwards channel. The bulls have been in full force that is for sure since the 1st of January 2013.

But the cypress bank news really has stopped things skidding up higher. Have a look at the chart below, you can see that the last week or so the market has not really done much at all. Ever since the cypress news, investors have become nervous and that nervousness has spilled across into the market.

This is a chart of the dow jones chart in 2013 and so far we have been travelling up nicely in an upwards channel. The bulls have been in full force that is for sure since the 1st of January 2013.

But the cypress bank news really has stopped things skidding up higher. Have a look at the chart below, you can see that the last week or so the market has not really done much at all. Ever since the cypress news, investors have become nervous and that nervousness has spilled across into the market.

The market breadth for the dow jones chart 2013 has sentiment trader a little bit complacent right now....and we are.....{{ VIP MEMBERS ONLY }}

Free SENTIMENT Newsletter (Worth $97)

.

.

Monday, 18 March 2013

cypress bank run - is there a cypress bank run coming

cypress bank run

Is there a cypress bank run on the way? Especially with all these talks of a cypress bank bailout on the cards.

The cypress 10% levy of bank saving has the I.M.F worried. They say it sets a dangerous precedence and fears a mass withdraw of funds in Cypress and abroad. A cypress bank run could have massive ramification for both the public and governments, but tensions are tight right now, and fevers high.

Pictures above show protesters writing the words NO on their hands, opposing banks penalizing depositors this week. They are angry that even small account holders will be raided to help fund the cypress bailout. The deal by the European Union has already been rejected amid fears for a massive cypress bank run.

Protesters are angry it has taken 40 years to build up their economy to the state it is right now, and within 24 hours it has been shot down in flames. One protester stated the obvious. "If they can do this to depositors here, they can do it to depositors anywhere in the world, and that is pure theft to all of us!"

Europeans believe in Europe but the government has now betrayed that trust, increasing the chances of a run of banks, or a cypress bank run.

Banks and some ATM's have been closed till THURSDAY fearing a possible cypress bank run or run on banks in some areas, and it has the public very nervous. Some ATM's are limiting funds but the theory there is a possible cypress bank run could quickly turn into a stampede of people scrambling to get their money out at the same time which could have severe consequences.

Bankers on the other hand are worried that doing a bailout could send signals that banks are no more a safe option just as people were beginning to regain a little confidence.

Right now everyone is on edge as a cypress bank run is a possibility and it seems a total revision is coming down the track in EUROPE and right now things are way to fragile to risk another full blow crisis.

cypress bank bailout

cypress bank run

Powered by 123ContactForm | Report abuse

For all other enquiries ==> CLICK HERE TO CONTACT US

Is there a cypress bank run on the way? Especially with all these talks of a cypress bank bailout on the cards.

The cypress 10% levy of bank saving has the I.M.F worried. They say it sets a dangerous precedence and fears a mass withdraw of funds in Cypress and abroad. A cypress bank run could have massive ramification for both the public and governments, but tensions are tight right now, and fevers high.

|

| cypress bank run |

Pictures above show protesters writing the words NO on their hands, opposing banks penalizing depositors this week. They are angry that even small account holders will be raided to help fund the cypress bailout. The deal by the European Union has already been rejected amid fears for a massive cypress bank run.

Protesters are angry it has taken 40 years to build up their economy to the state it is right now, and within 24 hours it has been shot down in flames. One protester stated the obvious. "If they can do this to depositors here, they can do it to depositors anywhere in the world, and that is pure theft to all of us!"

Europeans believe in Europe but the government has now betrayed that trust, increasing the chances of a run of banks, or a cypress bank run.

Banks and some ATM's have been closed till THURSDAY fearing a possible cypress bank run or run on banks in some areas, and it has the public very nervous. Some ATM's are limiting funds but the theory there is a possible cypress bank run could quickly turn into a stampede of people scrambling to get their money out at the same time which could have severe consequences.

|

| cypress bank run |

Bankers on the other hand are worried that doing a bailout could send signals that banks are no more a safe option just as people were beginning to regain a little confidence.

Right now everyone is on edge as a cypress bank run is a possibility and it seems a total revision is coming down the track in EUROPE and right now things are way to fragile to risk another full blow crisis.

cypress bank bailout

cypress bank run

.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!Powered by 123ContactForm | Report abuse

mcclellan oscillator chart - The mcclellan oscillator chart is telling the tale

mcclellan oscillator chart

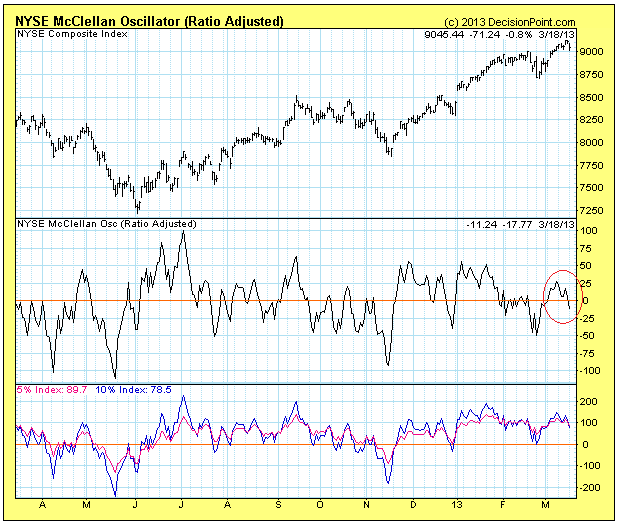

I think the mcclellan oscillator chart is telling the tale at the moment, and with this cypress bank bailout news it is having some sort of effect on the markets.

As you can see the mcclellan oscillator chart is saying things are not as strong right now.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

I think the mcclellan oscillator chart is telling the tale at the moment, and with this cypress bank bailout news it is having some sort of effect on the markets.

As you can see the mcclellan oscillator chart is saying things are not as strong right now.

|

| McClellan Oscillator |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

cypress bank bailout - the current cypress bank bailout

cypress bank bailout

cypress bank bailout news headlines hit the media over the weekend and it is already effecting the market, which is not even open yet.

European central bankers are exacting a high price for the cypress bank bailout, but, ultimately it is the Cypriot people who will pay the price. Greece, which is in a fiscal devil's circle itself, sent as muchh as 5 billion euros to Cyprus, reportedly to help the Cypriot banks meet cash requirements.

But it may all be in vain if there is a bank run, where angry people have already been dunned for 10 percent of their savings accounts--and won't be able to withdraw money from their accounts.

The Cypriot cabinet has declared Tuesday a bank holiday, for fear of capital flight, and this may even be stretched to Wednesday, as depositors are certain to withdraw huge sums from the Cypriot banks after the haircut imposed. Since then news of the cypress bank bailout has hit the media headlines and across the globe, in a horrible ground hog day like event that happened a few years ago.

Nicosia postponed from Sunday to Monday the tabling in Parliament of the bill including the measures for the Cypriot bailout – including a bank account haircut and a tax hike on interest and corporate earnings – but the European Central Bank insists on a rapid voting because there are already signs a domino effect will follow across European lenders and markets from Monday. So do not expect this cypress bank bailout news to simple go away anytime soon.

There is genuine fear of market unrest on Monday morning when stocks may crumble in the eurozone and bank accounts in other southern European bank may suffer.

The so-called bail out deal has already cost Cypriots billions of dollars, as the Eurozone's 10 percent levy on bank accounts came into effect. Angry desitors can't get the rest of their money out of the bank, due the bank holiday which now extends to Wednesday.

The Eurozone "levy" on Cypriot banks is roughly one third of the nation's GDP, according to some sources. Imagine, how that would affect the US. According to Wikipedia:

The economy of the United States is the world's largest national economy and the world's second largest overall economy, the GDP of theEU being approximately $2 trillion larger. Its nominal GDP was estimated to be $15.8 trillion in 2012 ,[1] approximately a quarter of nominal global GDP.[2] Its GDP at purchasing power parity is the largest in the world, approximately a fifth of global GDP at purchasing power parity.[2]

Imagine if the US economy was (and is) in such financial straits that some entity bailed us out, but only if they levied one third of our GDP as payment. That would be a third of $15.8 trillion dollars. That would be roughly $5.2 trillion dollars. If the Cypriots are screaming, what would we be doing?

cypress bank bail

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

For all other enquiries ==> CLICK HERE TO CONTACT US

.

cypress bank bailout news headlines hit the media over the weekend and it is already effecting the market, which is not even open yet.

European central bankers are exacting a high price for the cypress bank bailout, but, ultimately it is the Cypriot people who will pay the price. Greece, which is in a fiscal devil's circle itself, sent as muchh as 5 billion euros to Cyprus, reportedly to help the Cypriot banks meet cash requirements.

|

| cypress bank bailout |

But it may all be in vain if there is a bank run, where angry people have already been dunned for 10 percent of their savings accounts--and won't be able to withdraw money from their accounts.

The Cypriot cabinet has declared Tuesday a bank holiday, for fear of capital flight, and this may even be stretched to Wednesday, as depositors are certain to withdraw huge sums from the Cypriot banks after the haircut imposed. Since then news of the cypress bank bailout has hit the media headlines and across the globe, in a horrible ground hog day like event that happened a few years ago.

Nicosia postponed from Sunday to Monday the tabling in Parliament of the bill including the measures for the Cypriot bailout – including a bank account haircut and a tax hike on interest and corporate earnings – but the European Central Bank insists on a rapid voting because there are already signs a domino effect will follow across European lenders and markets from Monday. So do not expect this cypress bank bailout news to simple go away anytime soon.

|

| cypress bank bailout |

There is genuine fear of market unrest on Monday morning when stocks may crumble in the eurozone and bank accounts in other southern European bank may suffer.

The so-called bail out deal has already cost Cypriots billions of dollars, as the Eurozone's 10 percent levy on bank accounts came into effect. Angry desitors can't get the rest of their money out of the bank, due the bank holiday which now extends to Wednesday.

The Eurozone "levy" on Cypriot banks is roughly one third of the nation's GDP, according to some sources. Imagine, how that would affect the US. According to Wikipedia:

The economy of the United States is the world's largest national economy and the world's second largest overall economy, the GDP of theEU being approximately $2 trillion larger. Its nominal GDP was estimated to be $15.8 trillion in 2012 ,[1] approximately a quarter of nominal global GDP.[2] Its GDP at purchasing power parity is the largest in the world, approximately a fifth of global GDP at purchasing power parity.[2]

Imagine if the US economy was (and is) in such financial straits that some entity bailed us out, but only if they levied one third of our GDP as payment. That would be a third of $15.8 trillion dollars. That would be roughly $5.2 trillion dollars. If the Cypriots are screaming, what would we be doing?

News of the bailout right now sunday night have the markets down by over 20 pts. So it is no doubt this is a serious problem on the minds of many, and we have been warning the market has been overbought in the last few weeks.

|

| cypress bank bailout |

cypress bank bail

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

.

Saturday, 16 March 2013

nasdaq daily volume - nasdaq daily chart and daily volume warning

nasdaq daily volume - nasdaq daily volume and what it means

The nasdaq daily volume on FRIDAY was higher than average. I have not seen this happen in opex for quite a while, and is very interesting.

As you can see nasdaq daily volume on friday was alot higher than its normal average volume, and it probably means the smart money was looking more to sell rather than buy.

Considering the nasdaq daily volume and also it is hard to update lately as the market has hardly been doing much at all. Is this just the calm before the storm. Well....time will tell. :-)

nasdaq daily volume

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

For all other enquiries ==> CLICK HERE TO CONTACT US

.

The nasdaq daily volume on FRIDAY was higher than average. I have not seen this happen in opex for quite a while, and is very interesting.

As you can see nasdaq daily volume on friday was alot higher than its normal average volume, and it probably means the smart money was looking more to sell rather than buy.

Considering the nasdaq daily volume and also it is hard to update lately as the market has hardly been doing much at all. Is this just the calm before the storm. Well....time will tell. :-)

nasdaq daily volume

|

| nasdaq daily volume |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Powered by 123ContactForm | Report abuse

.

market breadth indicators - current market breadth indicators are telling

market breadth indicators - current market breadth indicators are telling

market breadth indicators showing are very telling.

The current market breadth indicators have peaked nicely again at about the 280 level. The last time this happened we did see a correction on the market.

As you can see this chart can throw you off a bit at times, however is a good market breadth indicator and is usually good at telling traders where tops and bottoms are.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

market breadth indicators showing are very telling.

The current market breadth indicators have peaked nicely again at about the 280 level. The last time this happened we did see a correction on the market.

As you can see this chart can throw you off a bit at times, however is a good market breadth indicator and is usually good at telling traders where tops and bottoms are.

|

| market breadth indicators |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

bond price charts - The bond price charts

bond price charts

The bond price charts have bounced back in the last few days nearly touching the 50 ema line which would be a line in sands, and means that money could be swarming back to bonds and out of the market, so the next few days is critical.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The bond price charts have bounced back in the last few days nearly touching the 50 ema line which would be a line in sands, and means that money could be swarming back to bonds and out of the market, so the next few days is critical.

|

| bond price charts |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The Put Call ratio

Put Call ratio has recently peaked as you can see on the charts.

We are up at 80 and this is significant because we have not seen this level in over 6 months.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

We are up at 80 and this is significant because we have not seen this level in over 6 months.

|

| put call ratio |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Thursday, 14 March 2013

sp 500 index chart - latest sp 500 index chart

sp 500 index chart

The sp 500 index chart below is not moving much at all, infact we could say the market right now is producing a flat top, or in limbo (e.g. not moving much) and the bulls are trying to reach new highs. +

Remember tomorrow (FRIDAY 14th MARCH) is OPEX day and they can tend to run things up in opex weeks. However When I am trading OPEX I always expect the unexpected as over the years I have seen some rather bland action, or the opposite to that, very wild and crazy moves. Tomorrow we shall see which one we shall get. The sp 500 index chart is not really telling us too much yet! Can you feel the excitement :-P

The sp 500 index chart below shows us the market is trying to decide which way to go. The bulls and the bears are both fighting, like a tug of war, so far there is no clear winner. But we should have some more clarity in the next few days.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The sp 500 index chart below is not moving much at all, infact we could say the market right now is producing a flat top, or in limbo (e.g. not moving much) and the bulls are trying to reach new highs. +

Remember tomorrow (FRIDAY 14th MARCH) is OPEX day and they can tend to run things up in opex weeks. However When I am trading OPEX I always expect the unexpected as over the years I have seen some rather bland action, or the opposite to that, very wild and crazy moves. Tomorrow we shall see which one we shall get. The sp 500 index chart is not really telling us too much yet! Can you feel the excitement :-P

The sp 500 index chart below shows us the market is trying to decide which way to go. The bulls and the bears are both fighting, like a tug of war, so far there is no clear winner. But we should have some more clarity in the next few days.

|

| sp 500 index chart |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Labels:

flat top,

flat tops,

limbo,

market drops,

opex,

overbought,

oversold,

sp 500 index chart,

technical analysis

strength of us dollar chart - strength of us dollar chart amazing

strength of us dollar chart

The strength of us dollar chart has been discussed lately, and it is telling us a lot.

When You have a look at the strength of us dollar chart below you can see, it has been travelling in an upwards channel now for a few weeks and has not stopped. It seems the strength of us dollar chart means that money is coming in from other vehicles and into the US Dollar right now for many resasons. It does tend to be a seasonal thing, however, the strength of us dollar chart means we should be keeping a close eye on the stockmarket and global equities in the next few weeks.

For now strength of us dollar chart will keep it inside the current bullish channel.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

The strength of us dollar chart has been discussed lately, and it is telling us a lot.

When You have a look at the strength of us dollar chart below you can see, it has been travelling in an upwards channel now for a few weeks and has not stopped. It seems the strength of us dollar chart means that money is coming in from other vehicles and into the US Dollar right now for many resasons. It does tend to be a seasonal thing, however, the strength of us dollar chart means we should be keeping a close eye on the stockmarket and global equities in the next few weeks.

For now strength of us dollar chart will keep it inside the current bullish channel.

|

| strength of us dollar chart |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

bear vs bull market - bear vs bull market chart

bear vs bull market

Taking a quick peek at the bear vs bull market we can clearly see that we are currently still in a BULL MARKET, there is not doubt a bear market is far away, and you do not have to look at too many charts to realise the bulls really have taken some buying VIAGRA lately.

As you can see the red and blue lines have yet again gapped away from each other more extensively, confirming the strength of the market for 2013.

We do have legs to run alot higher in 2013, but one must remember things do not go up in a straight line and dips should be bought if and when they come.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Taking a quick peek at the bear vs bull market we can clearly see that we are currently still in a BULL MARKET, there is not doubt a bear market is far away, and you do not have to look at too many charts to realise the bulls really have taken some buying VIAGRA lately.

As you can see the red and blue lines have yet again gapped away from each other more extensively, confirming the strength of the market for 2013.

We do have legs to run alot higher in 2013, but one must remember things do not go up in a straight line and dips should be bought if and when they come.

|

| bear vs bull market |

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

Labels:

2013,

bear vs bull market,

bears and bulls,

bullish,

buy dips,

technical analysis,

viagra

Subscribe to:

Comments (Atom)