Icahn: Markets will have a day of reckoning

ACCESS OUT FULL PREMIUM ELITE VIP NEWSLETTERS & UPDATES!

See What The Fuss Is About - Try Us Free For 14 Days! - Limited Time Offer - Hurry!

Get access to our Daily analysis, videos, coaching, audio, charts and indicators AND MORE....=====================================================

Icahn: Markets will have a day of reckoning

|

| Icahn: Markets will have a day of reckoning |

Icahn: Markets will have a day of reckoning

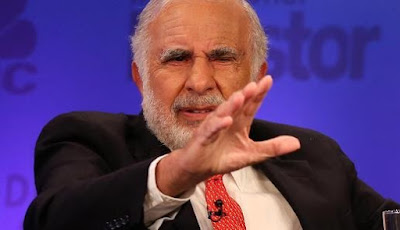

Billionaire investor Carl Icahn is "extremely cautious" on the U.S. market, he told reporters "Power Lunch" on Thursday.

"I do believe in general that there will be a day of reckoning unless we get fiscal stimulus," he said, pointing to the Federal Reserve's maintaining low interest rates, and potentially creating "tremendous bubbles."

On the fiscal side Icahn argued that "you certainly could do more spending."

"The Republican party that I used to be more sympathetic with — I'm right in the middle now, although as you know I'm for (GOP front-runner Donald) Trump — but what I would say is Congress is in this massive gridlock obsessed," he said, explaining that the Republican-controlled Congress is "obsessed with this deficit to a point that I think it's almost pathological."

Worrying about a deficit when there is no significant inflation and the dollar remains the global reserve currency is not a smart way to govern, Icahn said, adding that "a country is not a company."

As for actual bets, Icahn said he thought some commodities companies could see their share prices rise, but he has "a huge short position on."

"The short position obviously isn't working that well as the market goes up, but I have not changed my opinion," he said.

The famed investor has voiced a bearish opinion before, telling reporters in September that markets looked "way overpriced" and that many investors had put themselves into "dangerous" positions.

When you look at the apple chart, you can see the last 2 days, we gapped down HUGE! ouch!

The MACD on this chart has now entered a SELL SIGNAL, so you can see why Icahn did indeed sell his position. We break the lows seen in FEB 2016, and there could be even more trouble.

Billionaire investor Carl Icahn told reporters on Thursday he has sold his Apple position as the tech giant's stock continues to shed value after disappointing earnings.

"We no longer have a position in Apple," Icahn told reporters "Power Lunch," noting Apple is a "great company" and CEO Tim Cook is "doing a great job."

Icahn previously owned a little less than a percent of the tech giant's outstanding shares, which were down more than 3 percent midafternoon Thursday after falling more than 6 percent Wednesday. He said he made roughly $2 billion on Apple, a stock he continued to tout as "cheap" despite his reservations.

Icahn said China's attitude toward Apple largely drove him to exit his position.

"You worry a little bit — and maybe more than a little — about China's attitude," Icahn said, later adding that China's government could "come in and make it very difficult for Apple to sell there ... you can do pretty much what you want there."

He added, though, that if China "was basically steadied," he would buy back into Apple.

The company on Tuesday posted quarterly earnings of $1.90 per share on $50.56 billion in revenue, both of which missed Wall Street's expectations.

Apple's sales declined 13 percent from the prior-year period, its first year-over-year revenue drop since 2003. Sales of its key iPhone slid to 51.2 million from 61.2 million the previous year.

One area of weakness for Apple in the quarter was the Greater China segment — comprising mainland China, Taiwan and Hong Kong. Revenue for that region fell 26 percent year over year to $12.49 billion. Previously, that area had posted consistent growth for Apple.

Still, "we feel good about China," he said earlier this week.

"We remain very optimistic about the China market over the long term, and we are committed to investing there for the long run," Apple CFO Luca Maestri said Tuesday.

Icahn noted he called Cook to tell him he exited the position.

The activist investor purchased his Apple stake in 2013. He previously said buying into the company was a "no-brainer."

Last May, Icahn said he had a $240 per share price target on Apple when it traded around $130 per share. As recently as September, Icahn said he considered buying more of the company's stock, saying it looked cheap. So if it looks cheap now, maybe it will look cheaper by the end of 2016. Source : Cnbc.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse

With public sentiment, nothing can fail. Without it, nothing can succeed. See the link below for more info.

ReplyDelete#sentiment

www.ufgop.org