ACCESS OUT FULL PREMIUM ELITE VIP NEWSLETTERS & UPDATES!

See What The Fuss Is About - Try Us Free For 14 Days! - Limited Time Offer - Hurry!

Get access to our Daily analysis, videos, coaching, audio, charts and indicators AND MORE....=====================================================

s&p 500 predictions - 2016 s&p 500 predictions

What We See?

Well its that time of year again!

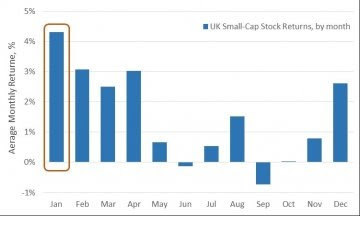

source : marketwatch

Yes! With santa out of the way, Wall Street stocks still looking a bit flat as the market closes out 2015. Crude oil CLG6, -3.36% is back to its downbeat ways, relinquishing most of the sizable gains the commodity scored last week. With crude down so much, the market is really feeling the pinch!

Stocks are under pressure. The S&P 500 index SPX, -0.37% which had been clinging to a meager annual gain as recently as Christmas Eve is looking at a 0.6% decline year to date, joining the Dow Jones Industrial Average DJIA, -0.25% down 2.1% year to date, in negative territory.

There are many equity strategists out there who are holding on to optimism for 2016, even as the stocks look set to limp out of the 2015.

Our view is oil is going to stabilize at a low level, and we will see some of the consumer dividend get spent next year, but there are some hurdles to get through as we go into 2016. We just cannot jump on the bandwith of all the BEARS out there. For us, doing that does not make sense.

Generally speaking, U.S. strategists aren’t particularly sanguine about the prospects for 2016, with many polled by MarketWatch offering 2016 forecasts that are lower than their 2015 predictions, as we head into the new year.

It is important to point out that there were a few of our predictions in 2015 that haven’t exactly panned out the way we anticipated. But we did accurately predict a bumpy ride in 2015, and even though no one can really see the future with the market, as anything can happen, we think that its a fair call that more volatility is going to occur next year.

In 2015, a stronger dollar, which gained more than 8% this year, as measured by the ICE U.S. Dollar Index DXY, +0.04% has limited profits for big U.S. companies. Plunging oil has raised fears about the earnings power of energy companies and stoked concern about problems in high-yield bonds HYG, -0.56% spilling over into the broader market.

With a rising US dollar, corporate earnings will be key to the market’s success in 2016. But it is hard to see the dollar’s strength abating in the face of expectations that the Federal Reserve will continue to normalize interest rates next year, and calling the bottom of oil’s stunning price collapse has been a losing effort so far

s&p 500 predictions - 2016 s&p 500 predictions

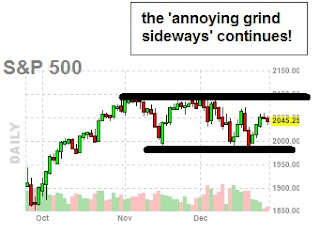

Bulls and bears are locked in a year-end tug-of-war, as the chart below shows. We can tell you that the end of year has a bias to the upside, and so far that has been playing true, however as you can see on the daily S&P chart below, we have been in nothing more than a sideways market. Its pretty much pissing off the bulls and the bears out there.

|

| s&p 500 predictions |

Contrarians currently are neutral about the stock market’s near-term direction, since the current Wall Street consensus is neither excessively bullish nor excessively bearish.

This will come as good news if you were worried that there might still be too much bullishness out there that needs to be worked off. But this news will be discouraging if you were hoping that the market’s recent declines were enough to completely rebuild the Wall of Worry that rallies like to climb.

Consider the average recommended equity exposure among a subset of short-term stock market timers monitored by the Hulbert Financial Digest (as measured by the Hulbert Stock Newsletter Sentiment Index, or HSNSI). This average currently stands at 31.4%, less than half the 65.7% reading registered in the first week of December. But some of the big hedge funds that follow this has gone broke this year. This is not a market where you buy and hold anymore, that does not work.

The speed and extent of this drop is encouraging, since it suggests that there is not the kind of stubbornly held bullishness that often accompanies major market tops. A textbook illustration of that kind of bullishness came at the top of the Internet bubble in March 2000, when — in the wake of the first 10% correction off the market’s all-time highs — the average market timer became even more bullish.

Barron's Senior Editor Jack Hough previews the latest issue of Barron's, which includes the value of investing in money managers, the advertising sector outlook for 2016, and the attractiveness of some junk bonds. Photo: Getty

So it’s definitely good news that we’re not following that script from 15 years ago.

Why, then, aren’t contrarians more bullish now? The answer is implicit in the chart accompanying this column: Even though the HSNSI has fallen dramatically over the last two weeks, it still hasn’t hit the even-lower levels that have accompanied the most significant bottoms of the last couple of years.

You may find it frustrating that contrarian analysis doesn’t produce a clear and unambiguous forecast of either a higher or lower market. But it’s worth remembering that only rarely do good stock market indicators provide such “shout from the rooftops” signals. Most of the time they are in-between those extremes.

Now appears to be just such a time

We are seeing some significant signs that 2016 can be a bullish year! I guess that is good news, however what you do not want to see is the BOTTOM fall out of the market in the next few weeks. If that was to happen, it would not represent a good situation at all.

Next year we see rapid developments in technology too. That is good news and likely to hold up the market as well. We are now living in a world, where things are moving so fast, the next and broadcasters cannot keep up. Iphones, apps, drones, hoverboards are all hot topics and on everyone Christmas list. The world in which we live is speeding up, the market can smell it, and it loves the though that this TECHNOLOGY boom is just what the doctor prescribed. We are living on the edge of a boom not seen before. It reminds us to a similar situation back in the DOT com days, when things grew too fast for itself, and ended up on a DOT COM CRASH, but realistically you have to see massive euphoria first, and we can defiantly say we are no where there yet. We will get there, but its probably going to take years! For now we just bask in the sun and hope the market does not see a down-leg here at the end of 2015, if that was to happen, it would be nothing more than a warning shot across the bow. But because the market held so well, in 2015 this could be one of those consolidation years, before we see another leg higher in the TECH BOOM, and the MARKET itself. Time will tell. :-)

I cover more and more technical analysis ==> HERE in our VIP members section.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse