january effect stock market

are we in a bear market

ACCESS OUT FULL PREMIUM ELITE VIP NEWSLETTERS & UPDATES!

See What The Fuss Is About - Try Us Free For 14 Days! - Limited Time Offer - Hurry!

Get access to our Daily analysis, videos, coaching, audio, charts and indicators AND MORE....=====================================================

january effect stock market ?

january effect stock market

Over the last 30 years, we have made money from the january effect stock market about 75% of the time, broken even about 10% of the time, and lost money about 15% of the time. Odds favor that the january effect stock market will be profitable this year.

The stock market is dynamic and as such at The Arora Report these zones are reviewed daily and revised as appropriate. One chart is shown below.

Under one potential scenario, the stock dips and there is a fill at $2.00 in December. In January the stock bounces strong and the average exit is at $8.00.In this scenario, the return will be 300% in about a month or 3600% annualized.

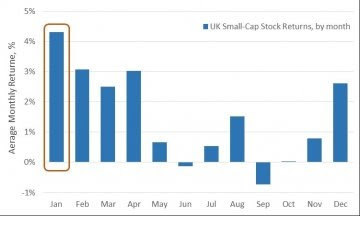

Here is a CHART that shows the strongest market months going back over 100 years. As you can see JANUARY is one of the leading and strongest months, when you go and look back. December is also another strong, and well performer.

|

| january effect stock market |

Why did I start out the column by suggesting a return of only about 30%? Please read on for the answer.

Why dips occur in certain stocks providing opportunities

The practical way to take advantage of the january effect stock market is to buy dips in certain stocks that may occur for the following two reasons:

1. Tax-loss selling. One strategy that is commonly employed by investors is to offset gains by taking losses on certain stocks. Such selling for tax purposes artificially depresses the price of certain stocks.

2. Window dressing. Portfolio managers in their year-end reports do not want to show investors that they were holding stocks that did not do well. Therefore they sell such stocks artificially depressing them further.

Two reasons behind the january effect stock market

The january effect stock market occurs for two reasons.

1. Investors buy stocks in January that were artificially depressed because of tax-loss selling in the prior year.

2. In January, Wall Street professionals get big bonuses. Those with big bonus prefer bargain stocks and drive up the prices of the stocks that were losers the previous year.

The conventional wisdom is that this january effect stock market applies only to small stocks. Our experience is that the effect is not limited to small stocks but applies to depressed stocks in general.

How to reduce risk

At The Arora Report, we advocate a basket strategy to reduce risk. The Arora Report has published a basket of 71 stocks to profit from the january effect stock market along with buy zones and position sizes. Most of the buy zones are below the market. The plan is to catch down spikes. Typically only 15%-25% of the stocks on the list get fills.

All stocks with fills will not be winners, there will be losers. Even some winners will have puny returns.Typically two or three stocks end up with monster returns.The average return typically ends up about 30% over three months.

When to buy

Thirty years ago, one could simply buy depressed stocks in the last week of December. Now that the phenomenon has become well known, the time to buy is earlier. These calls to buy remain valid until about Jan. 10. On Jan. 11, consider canceling all open orders that have not filled. After Jan. 10, the securities on the list that have not filled are no longer valid recommendations and are withdrawn.

When to take gains

Typically, gains are taken in the period of late January to early April.

Managing the trades

A practical way is to put in good-til-canceled orders (GTC). Consider putting small orders in tranches spread out in the buy zones. All orders will not fill. If there are not many fills, consider raising the order prices. Every year there have been a handful of stocks on the list that came within $0.25 of the top band of the buy zone and then went on to double. For this reason, aggressive investors may want to take liberty with the top end of the buy zones. If buying above the top band of the buy zone, consider reducing the quantity to reduce risk.

If you already hold some of the stocks in the basket, consider excluding those from your january effect stock market list.

Of course nothing is set in stone, and when we think of the stock market, and what it has been doing in the last 12 months, its been UP .... DOWN, and all around in 2015. To say its a very very volatile environment over the last few years, surely is an understatement. I seriously doubt that that will change in 2016 and onwards. But it can mean me big things, and a lot of our VIP MEMBERS HERE are thriving in this time period basically because they are doing more things than the average trader out there. Well, technically they are not doing more things, they are just able to see the HUGE opportunities out there at the moment that others think do not exist. There are plenty of ways to make money. Sometimes when the carrots are dangling right in front of your eyes, its still hard to see them. If you know what I mean?

You have to look at the tree amongst the forest so to speak, when you have LOW INTEREST RATES, and violent swings on the market. BUY and HOLD strategies are almost a dying breed we would say, as more people realize you can make HUGE amounts of money on a smaller time frame in 2015, but you must be nimble, otherwise you can kiss your ass goodbye. :-D.... I am sure you know exactly what I mean by that. This is one of those markets that takes no prisoners, and asked no questions. It can cut you up, or can make you hit the jackpot super fast.

I cover more and more technical analysis ==> HERE in our VIP members section.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse

No comments:

Post a Comment