ACCESS OUT FULL PREMIUM ELITE VIP NEWSLETTERS & UPDATES!

See What The Fuss Is About - Try Us Free For 14 Days! - Limited Time Offer - Hurry!

Get access to our Daily analysis, videos, coaching, audio, charts and indicators AND MORE....=====================================================

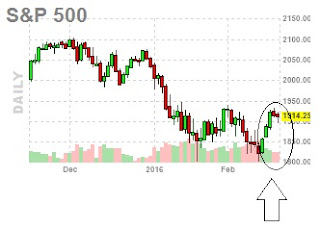

short-covering rally ?

Are we seeing the start of a major short-covering rally?

The market is looking like its hanging on a knife's edge here. Realistically.

The first thing you must realize is that we must differentiate the practice of short-selling from investing. It is true that short-selling can be part of an investment portfolio, but typically the practice of short-selling is a trading practice, and that is true even when it is imbedded in a larger portfolio. Therefore, short-selling is a form of trading, typically for short-term profits, and rarely with long-term time horizons in mind.

A person who often engage in short-selling practices are trading with short-term time frames in mind, which means that they are looking for short-term profits. Traders who engage positions like this are also often quick to get out of those positions if the short side of the market suddenly doesn't look as good as it did when they initiated it.

Using the market as an indicator, if a someone sells short the SPDR S&P 500 ETF and that position starts to work for him, but then there is a reason why that position may not continue to work like it did, the typical short seller would be inclined to take profits, get out of the position, and wait for another more ideal entry. Generally speaking, because of the nature of the trade, there are few short-sellers who are actually in it for the long haul.

Realistically its all about the mentality. This short-side mentality can make markets prone to short-covering rallies from time to time. For example, if the market declined aggressively over a short period of time and part of that decline was influenced by the short side of the market, it is reasonable to assume that once the market finds legs, stabilizes, and begins to turn higher, those short positions that were initiated before and which influenced the market lower could rush to cover.

What do you get? Covering those short positions is exactly what causes a short-covering rally, but it usually takes more than just a little offset to encourage short sellers to exit their positions. Reasonably, because the practice of trading involves faster decisions, deciding to cover short positions can snowball, and if short-sellers begin to cover as a group, they could cause a bid in the market and a rally to ensue.

I guess that in more ways than one, that is exactly what our current market environment is set up for.

What about the economy then? The underlying economy is weak, corporate earnings are not likely to be good, global growth rates are horrible, there is a liquidity crisis in terms of new money as that is defined by The Investment Rate (TM), and we are in the third major down period in us history akin to the Great Depression and stagflation, so the problems are not going to go away, but the market has been beaten down recently, and it is ripe for a short-covering rally.

Right now, you have lots of people saying the market will crash in 2016, and then the rest saying this is just a DIP IN A BULL MARKET. Lets be honest, the market has gotten a little ahead of itself for years now, and when that happens you usually get extreme volatility and also when you get the larger dips, the short covering rallies and violent and fast on the upside. They end up tricking shorts, and tricking longs all together and its not uncommon for both sides to lose money! So just remember that. Also remember that the S&P is currently in a downtrend, and these short covering rallies over the past 6 months do not last long at all. Maybe a few weeks at best, and then its back down crapper hole!.

I guess time will tell, to see if this is the start of a big rally, or just a short covering rally before more hard core selling is seen. Our thoughts are the latter, but we will know more in a month or so, obviously.

I cover more and more technical analysis ==> HERE in our VIP members section.

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse

No comments:

Post a Comment