You are probably reading the papers, the internet, and other media news channels seeing all they hype and hysteria surrounding gold. You are probably thinking to yourself, WOW! there are so many people buying gold right now. What is all the fuss about? And should you really be another to jump on the bandwagon?

|

| people buying gold - snap it up |

People buying gold has been almost a tradition for hundreds of years now, the reason is because gold is a highly sort after commodity and holds real worth. YES! It is true. There are stories back in the wild western days when trouble came to the financial system people would walk into their local shop, and buy goods or services with their gold.

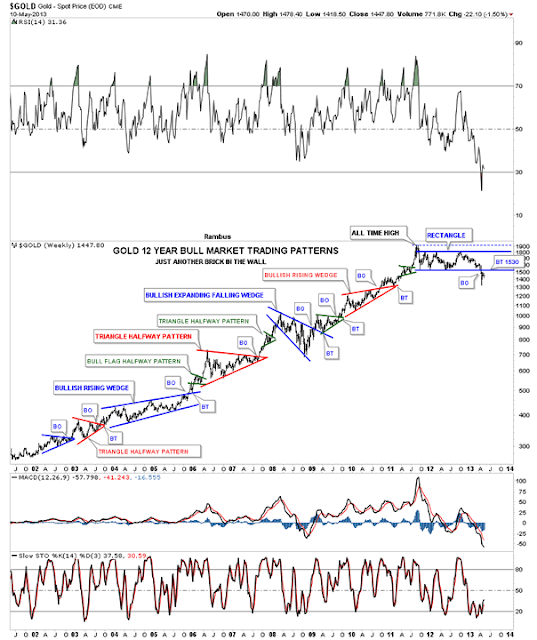

Ever since the horrific market crash back in 2008 the prices of gold has been rising dramatically. Forget the smaller sell offs along the way. I posted this chart a few weeks back showing what the price of gold has done over the last 12 years. It's quite an amazing chart when you zoom back and take a look at the bigger picture.

As you can see, if you bought gold 12 years ago, you would not only be doing well but cleaning up BIG TIME!

|

| people buying gold - gold price chart |

Today more investors, central banks, countries, and financial institutions are choosing to buy and own physical gold.

Check out our top 10 reasons to own gold and learn why now more than ever, gold ownership is on the rise.

1) Gold is universal money, a tangible store of value and wealth protection.

2) Physical gold cannot go bankrupt or broke. Gold bullion will never default on promises or obligations.

3) In times of crisis, gold bullion tends to increase sharply in value.

4) Gold is not created by governments nor is its value dependent upon governments. All of today's governments issue paper fiat currencies ( dollars, euros, yen, pounds, yuan, rupees, pesos, etc. ). Fiat currencies have no tangible value and are backed only by government decree ( namely legal tender laws ). Historically, governments always create and issue too much fiat currency. Over the longterm, paper fiat currencies are worth less and less, until they are ultimately worthless. The average lifespan of a fiat currency is 27 years.

5) Investors can buy and own physical gold privately and anonymously.

6) Super-national and national bank regulatory agencies are making moves to reclassify gold as zero percent risk-weighted asset helping to further drive physical demand from smaller banks.

7) Today, most nations are inflating and devaluing their respective fiat currency's purchasing power to both boost international trade and exports, and to more easily finance their nominal debts and social program liabilities. For instance, in the USA, retirees will most likely receive future promised Social Security checks... although there is no promise on how many goods and or services these checks will actually buy. Click here for data on fiat currency devaluations versus gold.

8) Gold bullion investments are extremely portable, liquid, and easy to store in one's home.

9) Governments and central banks are now net buyers of gold, meaning they are buying and hoarding more gold bullion than they are selling.

10) Politically or through market demand, governments will come under increasing pressure in returning to currencies backed by gold. Returning to a monetary system anchored in gold could cause the value of gold bullion to rise considerably in the months and years ahead.

So we feel that people buying gold is not just a fad now, it has been happening for 12 or so years. Even the central banks are buying up gold, and they are not doing this to lose money now are they?

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse

No comments:

Post a Comment