Over the weekend, I was looking at many charts. AI sentiment still showing us that we are in overbought territory with the S&P 500, however it does not look extreme.

As you can see we are in the sell zone, however on the line chart there is still room for us to wiggle up a bit higher. It looks like for months now the market has been creating a bearish rising wedge, and we must remember sentiment can shift however the first warning shot has not gone off yet, and it is possible we can see higher prices next week. Just a guess.

Our 1500 target has been hit :-) and the market on Friday shot up and is holding for now. The bulls still seem like they are not running out of steam just yet, so we must listen to that for now and forget the crowing roosters out there.

|

| AI Sentiment |

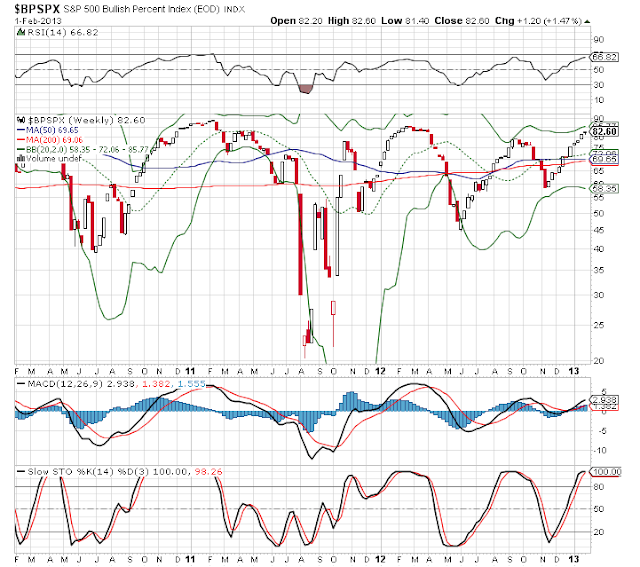

Taking a look at the S&P bullish percent, again we are still on a buy situation. We are up at 82.60 but there is no reason we cannot go up a bit more to ***** **VIP MEMBERS ONLY**

As you can see January has been a very good month, and very rewarding to the VIP MEMBERS

|

| spx index |

It seems the last few weeks, every man and his dog, and the so called expert pundits have been calling for a top on the market. Then the next week, more bears come out of the woodwork and call for a top again. It has not come yet! Are you starting to see a pattern here. LOL. Although this is not strange behavior, it has been quite entertaining.

Forget the pundits out there. All we need to do is read the charts for now and follow them. That has been working like gangbusters, and they will give us plenty of warning on what to expect and what actions to take next. :-)

Have a great weekend :-)

WHAT IF YOU KNEW WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE 10 Day Trial Offer Today!

No comments:

Post a Comment