As you have noticed we have been watching the weekly SPX chart very carefully! You have to love this chart if you are a trader, small or large as it really shows the power and how much the government has kept the markets afloat with their bullshit printing off of money.

"Hey you, check out this money we just printed, lets chuck it in the market!"

That is an awesome idea.....NOT! :-P

I can sit here all day and tell you how stupid the government is, and how much they love to work against you in your day to day life.....can you say *cough* Edward Snowden *cough* haha. LOL.

Yes I can ream on all day about the government, but realistically I wont waist my time because it will not help you make money on the market.

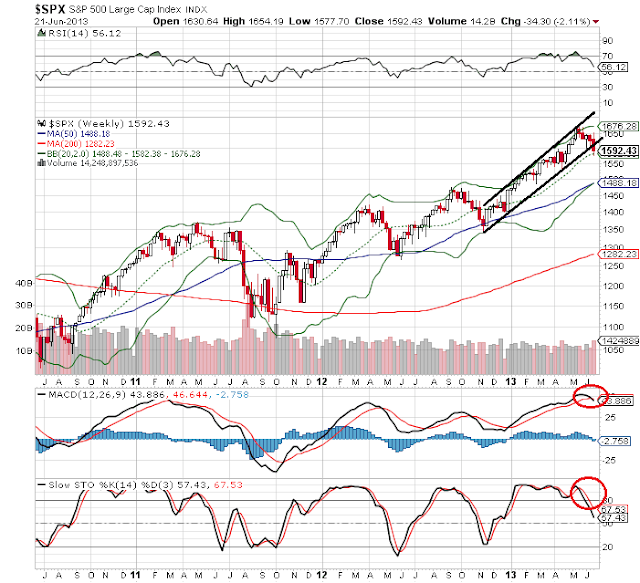

Back to the charts : So in laymens terms the weekly chart has now busted out of a nice rising channel it has been in since DECEMBER 2012. The stochastics and macd are also on a sell signal right now, so we have a big warning sign the market is about to hit the skids some more and a more down could be on the way in the next several weeks.

Even if we do see more profit taking and selling off, I would not go falling in love with the downside.

Yes the market does have some downside work to do, infact there could be some more violent selling off, but again, there are too many people screaming for a crash to 666 on the S&P. Now I am not saying that wont happen, but that is a low probability is all. I have posted many charts here in the blog that confirm we are still in a bull market. And we have to remember that bull markets do not go up in a straight line, that is for sure.

Looks like with the action we have seen in the last two weeks, we are going to have a very volatile summer on our hands. For some this will be great, and I love trading in this environment, but for others, they will get chopped up and lose their accounts. So you have been warned.

|

| spx weekly chart |

WHAT IF YOU KNEW

WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by 123ContactForm | Report abuse

No comments:

Post a Comment